Trump, Tariffs, and the Art of Staying the Course

We aren’t huge fans of twenty-four-hour rolling news here at Thorntons Investments. Well, that’s not entirely true: having all the world’s information available to you at all times can prove invaluable when forming client portfolios. More accurately, we aren’t huge fans of sensationalist headlines that are part and parcel of the news agenda.

“Worst week for US stocks since Covid crash” and “Tariffs have shaken the markets – how worried should I be?” were just two of the headlines I saw on Saturday morning – and that was on the BBC News app alone. In my opinion, this sows a level of concern and consternation above that required for the man on the street. If you are standing at your desk with a stripey blazer on, a phone on each ear, yelling “sell, sell, sell”, or if your entire investment strategy is based on sitting in a darkened room day-trading online, then you should be worried by the fall in prices day-to-day, week-to-week, or, at a stretch, month-to-month. Mercifully, we are neither of these things, and as investor with us, my assumption is that you aren’t either.

I am heartened by the absence of emails and phone calls from clients this week, indicating to me a level of understanding in how markets work, but also a level of trust and comfort with us as your investment managers. It is not something we take for granted.

Of course, the underlying facts supporting these headlines are true. Markets have had a torrid start to 2025, driven almost exclusively by Trump’s tariff policies and announcements. The S&P 500, which has been, by some distance, the best stockmarket over the last decade is down 13.5% year-to-date. The Russell 2000, which focuses on smaller US companies, is down 18%. Most other indices across the globe are also down, but not by quite the same margin.

In every meeting you will have had with us over the years, and at the footing of most letters and commentaries, we extol the virtues of diversification. And this is never truer than in moments of market difficulty. As investors, we aren’t immune to the falls noted above. We wouldn’t be doing our job properly if we didn’t have some exposure to equities and the major markets. But alongside the above, we try and give you exposure across as many asset classes and regions as we can – and if appropriate. This varies depending on your risk group, but whilst equities are falling, it is often the case that something else is picking up the slack. In this iteration, it is gold we are seeing soar to an all-time-high.

We don’t have any clients invested in a single asset class or market, nor will we ever. If that is the manner you’d wish to be exposed, we are not the investment manager for you.

Alongside diversification, the other thing to bear in mind in times of difficulty is your specific long-term objective, and investment timeline. It is a much trotted out adage, but investments are for decades not days, and that should always be the thought you revert to when headlines are prompting panic.

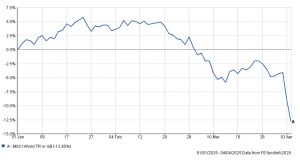

The chart below shows the performance of the MSCI World Index from 1 January 2025 to 5 April 2025. As you can see, it does not make for happy viewing, and if your investment time horizon had been 3 months you would be understandably distraught.

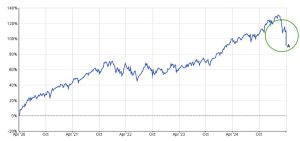

By way of comparison, the below chart shows the same index over the last five years. The area circled in green the first three months of 2025.

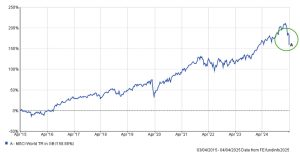

And finally, the area circled in green below highlights the first three months of 2025 but as part of a ten-year performance chart.

The graphs are for illustrative purposes, but what I am trying to show, albeit rather crudely, is that the longer you stay invested the smaller and more insignificant these ‘blips’ become. Over 10 years the MSCI World Index has returned 159% – that is a period that includes Brexit, a global pandemic, accelerating inflation, rising interest rates, the war in Ukraine, and two iterations of Donald Trump. Markets can fall quickly, but in most instances, they bounce back quickly too. The key is to stick the course, absorb some of the pain, and refrain from making knee-jerk reactions. Often easier said than done, but I hope once again that this is why you’ve placed your trust in us.

The views expressed are those of Thorntons Investments. Although all care is taken to ensure the accuracy of facts, absolute accuracy is not guaranteed. The contents of the article are solely for information purposes and are not intended as investment advice or a recommendation to buy or sell securities. Opinions expressed are subject to change without notice. The value of an investment and income from it can fall as well as rise, past performance is no guarantee of future performance, and you may not get back the amount originally invested.