Time to be patient

‘The stock market is designed to transfer money from the active to the patient’ – Warren Buffett

With headlines providing a steady stream of less than good news, we are writing to provide some illustrations which we hope will ease any concerns you have, and hopefully frame current volatility in the context of long-term market returns.

At varying times, investing can be both enjoyable and uncomfortable. It is only natural to have moments of wishing you invested more in rising markets but also to question the sense in investing when you see values fall. As portfolio managers, we treat your investments as if they are our own. We put ourselves in your shoes and make choices based on our knowledge of you and your circumstances, our experience, and the data available to us.

We are, undoubtedly, in a period of uncertainty for financial markets and it can make for difficult viewing. These periods of negative returns are part of the wider picture, however, and we do prepare portfolios as such.

For illustrative purposes, the graph below shows the returns of the PIMFA MSCI Balanced Index and the FTSE All Share over the past 6 months. PIMFA MSCI Balanced is the benchmark we use to compare against our Risk Group 6 portfolios, which are typically weighted 65% in equity and 35% in non-equity assets.

As you can see, portfolios and markets have had quite the roller coaster ride over the last 6 months. For those of you in a lower risk group we would expect the journey to have been far less severe but still daunting, whilst those of you in higher risk groups will have had quite the high-octane ride.

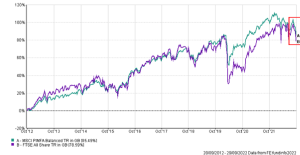

The following graph shows how the same indices have performed over a 10-year period, with the small red box to the right-hand side representative of the volatility shown above.

What this aims to illustrate is that although the current market movements are concerning and painful, they are a small part of the overall trend: a trend which generally sees investments move from bottom left to top right. Beginning your investment journey at certain parts of the cycle can cause great consternation, but history shows us time and again that sticking the course is the best plan.

It is not the first time we have seen turbulence such as this. As recently as 2008, 2011, 2016 & 2020 we saw periods of extreme volatility, and those with slightly longer memories will recall 1992 and 2000. What we learned in each of these episodes is volatility is short lived and markets begin returning to previous levels. For example, the recession of 2011 saw markets bounce back within 9 months; after the fall in March 2020 when lockdown arrived, markets had rebounded within 12 months. The events of the last few weeks feel more akin to the market shock felt in 2008 at the time of the banking crisis. Once again, however, by late 2009 markets did what they do and recovered to the pre-crash levels.

What this doesn’t mean is we sit on our hands and do nothing. We continue to monitor and manage your investments, looking to make changes as appropriate and gently guide portfolios. Wholesale changes are rarely accretive, and it is important to remember that we are invested for decades, not for days.

As portfolio managers, we want you to benefit from our guidance and reassurance that not wavering from your plan when things appear difficult is often the best outcome. We have seen markets fall and rise in the past and will see this again as the economic cycle continues.

As Warren Buffett has been quoted as saying ‘The stock market is designed to transfer money from the active to the patient’.

Let’s continue to be patient.

This information has been prepared using all reasonable care. It is not guaranteed as to its accuracy, and it is published solely for information purposes. It is not to be construed as a solicitation or offer to buy or sell securities and does not in any way constitute investment advice.

The value of investments and income from them may go down. You may not get back the original amount invested.

Past performance is not a reliable indicator of future performance.